Project return on investment calculator

Investment assets with a poor return on investment result in money loss. Disadvantages and Modifications of this Method.

How To Calculate The Return On Investment Roi Of Real Estate Stocks Youtube

With the IRR calculation cash flows can occur on any date.

. Since 1970 the highest 12-month return was 61 June 1982 through June 1983. Present value PV is the current worth of a future sum of money or stream of cash flows given a specified rate of return. From the beginning until the present he invested a total of 50000 into the project and his total profits to date sum up to 70000.

FHA Loan Calculatorestimate and evaluate the payments and options for FHA loans. But rememberan investment calculator doesnt replace professional advice. Assuming all project require same up-front investment then the one with higher IRR is considered as desirable.

Thus the investment does not yield the. A net present value of 0 indicates that the investment earns a return that equals the discount rate. Internal Rate of Return.

Such investment techniques or capital budgeting techniques are broadly divided into two criteria. An investment calculator is a simple way to estimate how your money will grow if you keep investing at the rate youre going right now. The compounding frequency matches the cash flow frequency.

Refinance Calculatorplan andor compare real estate loan refinancing options. Non-Discounting Cash Flow Criteria. The equation used for the MIRR calculation calculates a compounded rate of return unlike the IRR equation which assumes no compounding.

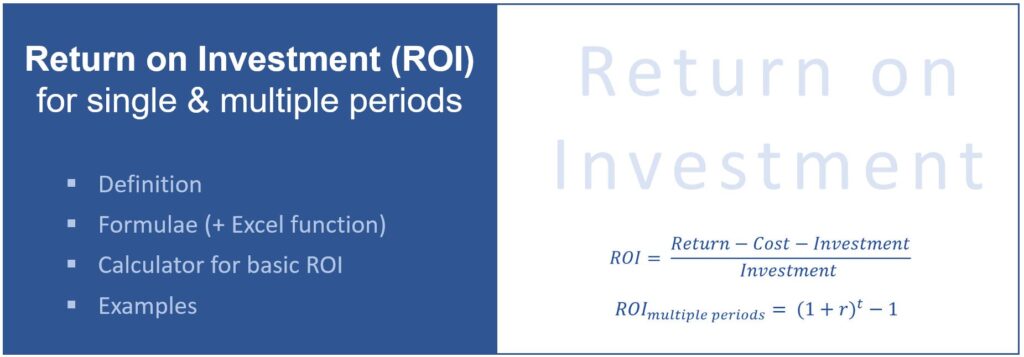

Using the future value calculator can help you plan and allocate resources more intelligently. Knowing the future value can help you decide between investing one way or another or spending the money now. The result is the annualized return in percent which however is not as accurate as the internal rate of return method if cash flows occur between the first and last periods.

If the required rate of return from the project is sat 10 and the average rate of return is coming out to be 15 that project will look worth investing. They could use an online IRR calculator or use the IRR formula in Microsoft Excel or Google Sheets. The lowest 12-month return was -43 March 2008 to March 2009.

The project value is now. IRR is a formula used to measure the estimated return of an investment or project. Internal Rate of Return IRR is the compounded rate of return on an investment with the inputs being the dates and cash inflowsoutflows.

Free online return on equity calculator. That can be detrimental and can lead us to make the wrong capital investment decision. Analyze the value of purchasing an investment property or renting your home or condo with the calculator below.

Mac Best Android VPN Best Project Management Software. I love the historical investment return calculator but I wish it would include money invested in a CD account. Free return on investment ROI calculator that returns total ROI rate and annualized ROI using either actual dates of investment or simply investment length.

Add your information in the green boxes to instantly calculate the ROI cash flow and IRR. If we were to calculate the IRR using a calculator the formula would take the future value. The IRR can also be thought of as the rate of return wherein the NPV of the project or investment equals.

Like we have discussed above the time value of money has been ignored in the average rate of return formula. Present Value - PV. If we think about things intuitively if one project assume all other things equal has a higher IRR then it must generate greater cash flows ie.

113780 85335 28445 savings per year. To measure the IRR a business would discount its expected future cash flows at a rate that makes the net present value of all the cash flows equal to zero. A decent rate of return is typically thought to be around 7 each year.

Im trying to do a comparison between investing in the SP 500. We can also think of the IRR as the expected compound rate of return of a project. Might need to understand that how this calculator works for calulating IRR or internal rate of return.

Assuming that quality has slipped a bit since the company increased its output to 528 units per year they are now considering an improvement project to reduce returned products by 25 percent. Home financial. Discounting Cash Flow Criteria.

VA Mortgage Calculatorestimate and evaluate the payments and options for VA loans. The initial investment date is the date you expect the project or investment to start. Calculating the return on investment ROI that a project gives your business is an essential part of reviewing finished projects and planning new ones.

An ROI calculation simply looks at how much a project costs and how much money it makes allowing you to. The return exceeds the predefined discount rate. Future cash flows are discounted at the discount.

Then the return on equity is equal to your return on. Its important to remember that adding value is not the same as return on investment ROI which is the amount of money you pocket after all of your costs. Net income Total equity Calculate.

Real Estate Investment Calculator. ROE formula meaning of return on equity and example calculations. Net Present Value NPV Benefit to Cost Ratio.

Meeting your investment goal is dependent on many factors. The NPV is negative if expenses are higher or occur earlier than the returns. A positive NPV suggests that the investment is profitable ie.

Discounting cash flow criteria has three techniques for evaluating an investment. Adjust any of the inputs and the results will instantly update to reflect the changes. In this case if the expenses surpass the revenue the investor will likely wind up with fewer than they spent.

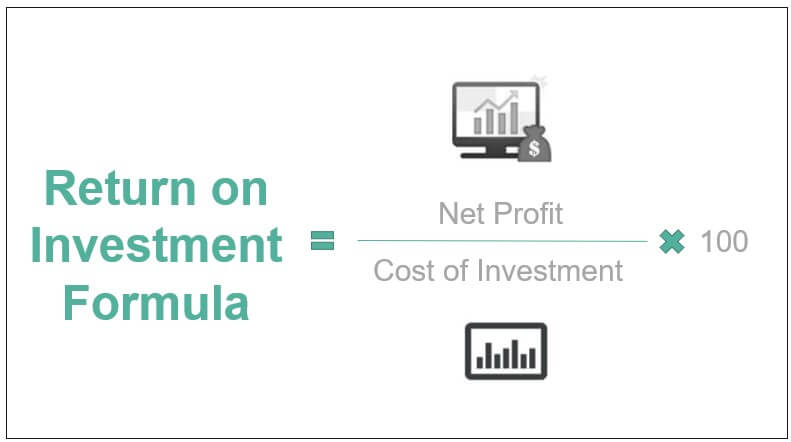

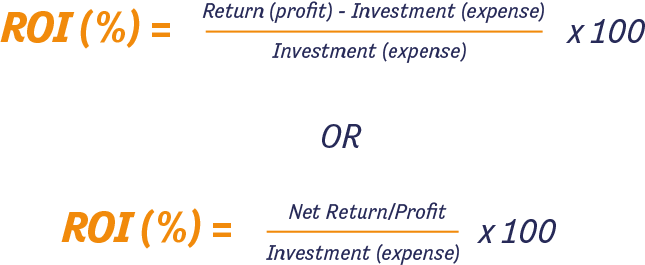

Our return on investment calculator can also be used to compare the efficiency of a few investments. The investment could be a deposit in a savings account a business project stock market portfolio investment fund etc. ROI calculator is a kind of investment calculator that enables you to estimate the profit or loss on your investment.

Mortgage Payoff Calculatorevaluate mortgage payoffs with additional or lump sum payments. Plus a host of other things Reply. IRR is used to evaluate desirability of a project or investment.

If you need help with your investments we recommend working with an expert wholl help you understand what youre investing in. The final cost reduction example is slightly more complex. Again this causes a loss and is undoubtedly a nightmare for investors.

This approach assumes that all returns occur in the form of a single cumulative inflow in the last period of the investments tenor. Based on the net income generated and the total value of the equity of the company or project. Use our ROI calculator to determine your return considering time horizon taxes and invested capital.

Understanding how much a project could potentially add to your homes resale value is the first step in determining whether or not the investment will pay off. Thus you will find the ROI formula helpful when you are going to make a financial decision. From January 1 1970 to December 31 st 2021 the average annual compounded rate of return for the SP 500 including reinvestment of dividends was approximately 113 source.

Return on investment is a metric used to understand the profitability of an investment. This calculator gives the user the ability to project and calculate investment returns adjust for inflation and deduct fees. A bigger numerator must be divided by a bigger denominator and hence IRR given the same initial costs.

In the given calculator above if your cash flow numberie.

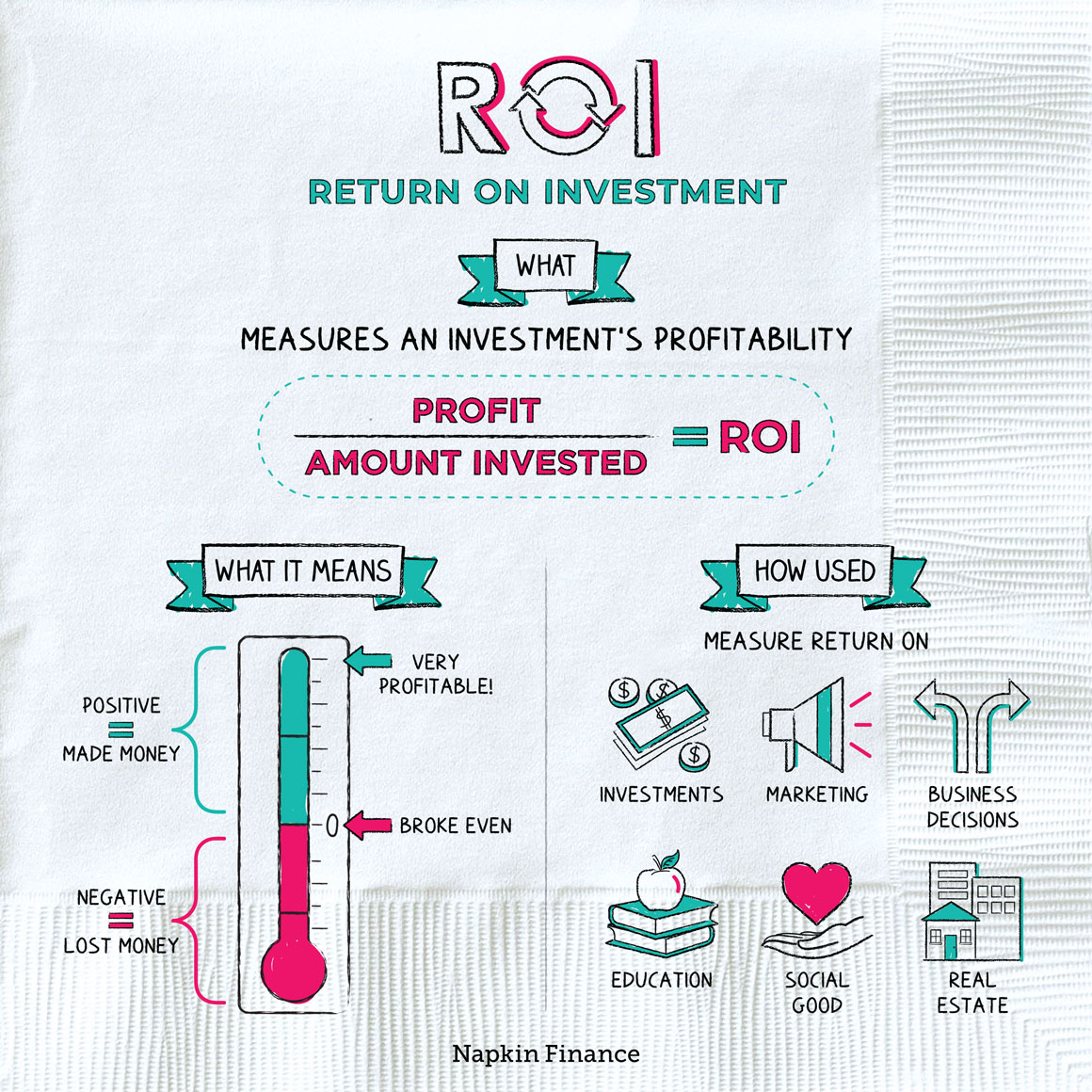

Roi Formula Calculate Roi And More From Napkin Finance

Return On Investment Roi Formula And Calculator Excel Template

Return On Investment Roi Formula And Calculator Excel Template

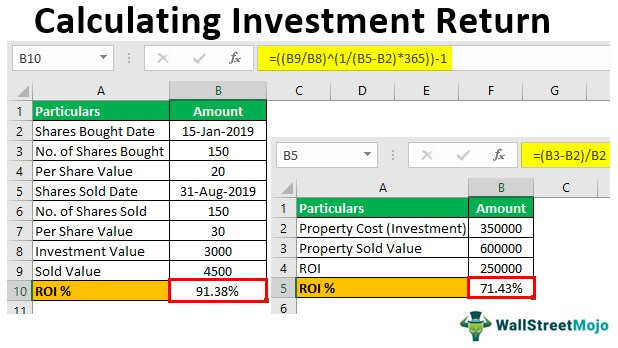

Calculating Investment Return In Excel Step By Step Examples

Return On Investment Definition Formula Roi Calculation

Projectmanagement Com Roi Calculation Worksheet

Roi Estimation Planning

Return On Investment The Ultimate Guide

Return On Investment Single Multi Period Roi Formulae Examples Calculator Project Management Info

5 Easy Ways To Measure The Roi Of Training

Return On Investment Roi Formula And Calculator Excel Template

Return On Investment Single Multi Period Roi Formulae Examples Calculator Project Management Info

Calculating Return On Investment Roi In Excel

How To Calculate Roi To Justify A Project Hbs Online

Roi Calculator Formula The Online Advertising Guide Ad Calculators

Return On Investment Single Multi Period Roi Formulae Examples Calculator Project Management Info

Return On Investment Roi Definition Equation How To Calculate It